Do you want to avoid the 3 biggest mistakes Americans make in their retirement? If you follow this formula you will protect yourself from these retirement train wrecks and have more success and more happiness in your life.

What are the mistakes? They are the following, and we help clients steer clear of them and have more confidence in their decision making every single day!

- Spending too much (especially on taxes)

- Poor investment decisions

- Ignoring long-term care

If you are like most Americans, you probably think you have already thought through these issues, and you’re saying to yourself,” No way. Not Me. We’ve covered these areas.”

Granted these 3 big mistakes may seem common knowledge, but our experience shows that most people have not adequately protected themselves against them.

1. Spending Too Much

For example, let’s dive into the first mistake, spending too much, with a question: What should your primary goal be in retirement? Your first goal in retirement should be to maintain your lifestyle throughout your entire life! To do that, your focus should be on cash flow; whatever comes into your household, minus whatever goes out.

Almost everybody we work with can tell us nearly to the penny what income they have. Almost nobody we work with can tell us exactly what they spend – even you budgeters tend to miss a thing here or there. The good news is that budgeting really doesn’t matter. What matters most is that long-term success is ultimately driven by spending and cash flow and how they work in tandem with your investments.

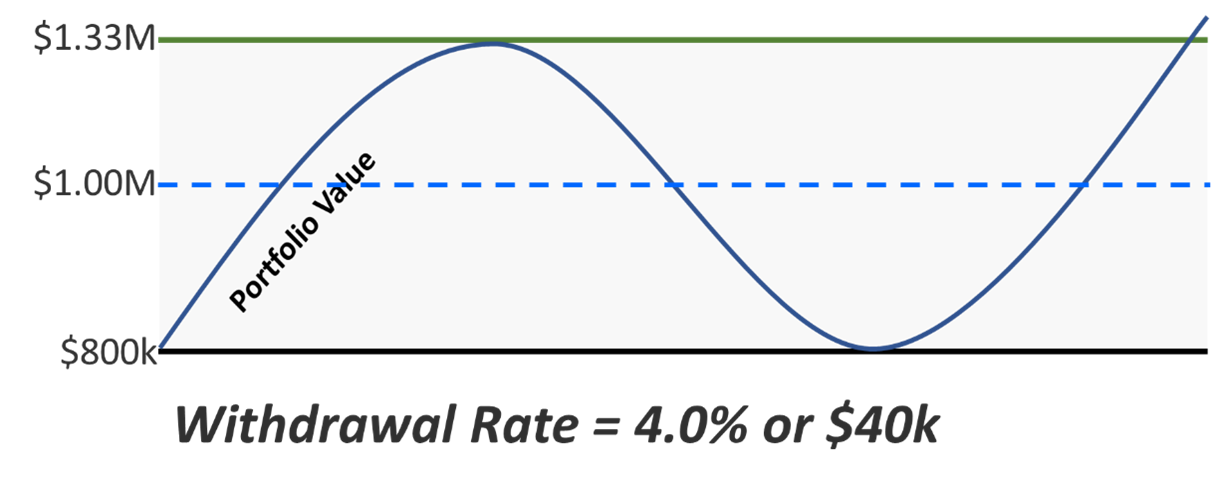

To make sure you can support your lifestyle in retirement and still protect yourself from emergency events, we typically recommend withdrawal rates from your portfolio of between 3%-5% annually. These amounts include one-time expenditures, as they rarely tend to be “one-time.” The graphic below shows how you can implement a spending “guardrail system” to provide guidelines and confidence that your retirement income spending is in line with your goals.

If you go outside the guardrails, you will have to make adjustments. If you pass the ceiling, you can take more money out. If you go through the floor, you will have to take less money out. Do you have a system in place to make sure you stay within prescribed spending limits?

Additionally, most retirees just pull money out when they need it and do not consider taxes. You can minimize your taxes by selling appreciated securities at a loss, to offset capital gains in other securities. You can also be conscious of the accounts from which you withdraw your money. If you have taxable brokerage accounts, it usually makes sense to draw those down first before you have to dip into your IRAs. The point is there are a myriad of ways to make sure you do not leave Uncle Sam a tip!

2. Poor investment decisions

Investors tend to suffer from an overconfidence bias which often leads people to overestimate their understanding of financial markets or specific investments and disregard data and expert advice. The result is often ill-advised attempts to time the market or build concentrations in risky investments they may consider a sure thing. Investors also tend to remember their winning picks and forget their losers. Investors hate admitting they were wrong and taking a loss!

The solution: Use risk management tools to take the emotion out of investing and increase the probability of better lifetime investment returns.

A: Diversification, which means owning different kinds of investments that will, on average, yield higher returns and pose a lower risk than any individual investment found within your portfolio.

You should do it because you will … never own enough of one thing to get killed by it! Just ask the people who had their entire 401ks invested in Enron!!!

B: Asset allocation is how you’re diversified among the three major asset classes: Stocks, Bonds, and Cash.

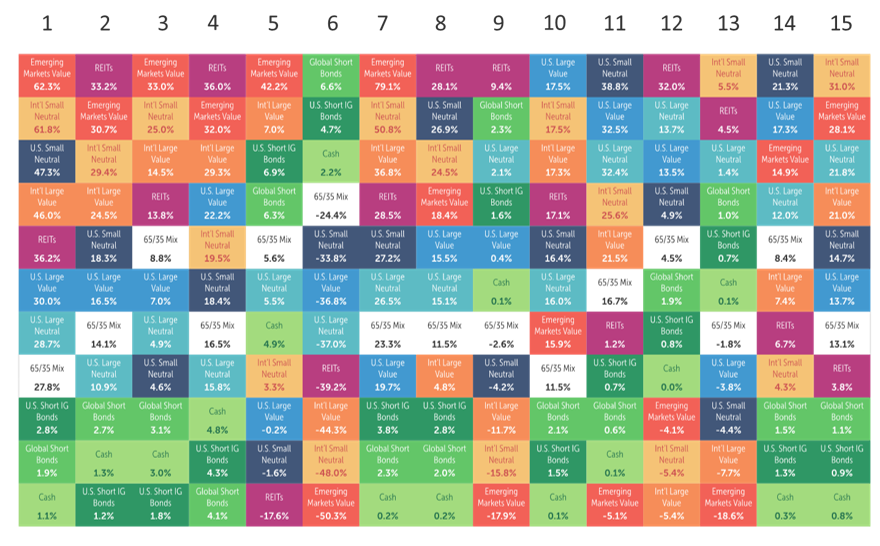

It’s based on the concept that you can’t possibly know which asset category or which sectors are going to do well next, and which are going to fall out of favor for a season or two. Therefore, you should own a number of opposing sets in order to capture global market returns.

Try picking the winning asset category during this 15-year period:

Maybe it is easier if you block out all the noise:

Did you guess Emerging Markets as the winner?

The point is no one can consistently predict the winner, so why even try. Just set an allocation that is appropriate to achieve the return you need to fund your goals and is suitable for the level of risk you think you can tolerate. Then, leave it – unless your investment objectives change. Otherwise, chances are you are changing your portfolio due to emotions, fear or greed.

C: Rebalancing realigns your portfolio with the original asset allocation you choose as an investor. Rebalancing is not market timing, please see our prior article on this topic by clicking here.

It is a process that has an astonishingly powerful effect because it systematically ensures that the investments that are up the most, are the ones being sold, and the ones that are down the most, are the ones being bought. It instills the proper behavior in an investor without even having to think about it!

The benefits are it removes any guesswork from investing. It keeps your portfolio structured at the appropriate level of stock for both your goals and your risk tolerance. In other words, it forces you to buy low and sell high, the stated goal of every investor!

Rebalancing is especially important for retirees who are distributing from their portfolio because it ensures you never take from the asset class that is down the most, and it allows retirees to continue to buy more equities when the market is down.

3. Ignoring Long-Term Care

The common misconception is that long-term care insurance is too expensive. So, you can choose to do nothing, as most people do, or you can look at the math.

It may surprise you find out that the average long-term care event can cost about $500,000 over five years. That is a lot of money to take out of your portfolio, robbing you not just of your wealth, but of your independence and enjoyment as well.

Nowadays, there are hybrid life insurance, long-term care products with a one-time down payment. These products usually start with a premium of $50,000 to $100,000 that can get you $200,000 to about $260,000 worth of coverage on day one. And the good part is that this coverage grows with inflation with no additional premiums.

Here is a hypothetical and simplified example:

- Say you buy a Permanent Life Insurance product for $250,000. It has a long-term care rider for $50,000.

- Now let’s say you use the $50,000 rider for long-term care and pass away. Your beneficiaries now get $200,000, or the $250,000 one-time premium, minus the $50,000 you used for long-term care.

People like these products because they feel as though they are going to use it one way or another: Either they can use it to pay for long-term care, or to transfer some of their wealth once they pass away. As I am sure you can see, when it comes to long-term care, the cost of do nothing, can cost more than doing something.

What is the simple formula to protect yourself from these retirement train wrecks?

To protect yourself from these top 3 retirement mistakes, it all boils down to making good decisions now! You do that through a financial plan.

Charles Schwab, Wells Fargo, Gallup Poll have all done studies that indicate people are twice as likely to retire with enough to maintain their lifestyle and to be prepared for an unforeseen event when they have a written plan:

- The financial plan will define proper, flexible spending limits to give you the freedom to spend on the things you enjoy most, but also the comfort to know you will not run out of money.

- The financial plan will systematize your investing by diversifying your investments, defining the proper asset allocation to reach you goals and limit losses, and setting a regular schedule for rebalancing.

- The financial plan will help you understand the real risk and magnitude of a long-term care event, and better yet, it should tell you if you can really afford a protect to protect yourself.

Let’s face it, nobody makes mistakes when things are good. It’s when things are bad that people mess up! And that is where you find the greatest value with a plan.

The choices you make will have a far bigger impact on your financial life than any other factor. A good financial plan should help you make those choices and give you the confidence that you have protected yourself from the top 3 retirement mistakes most people make!