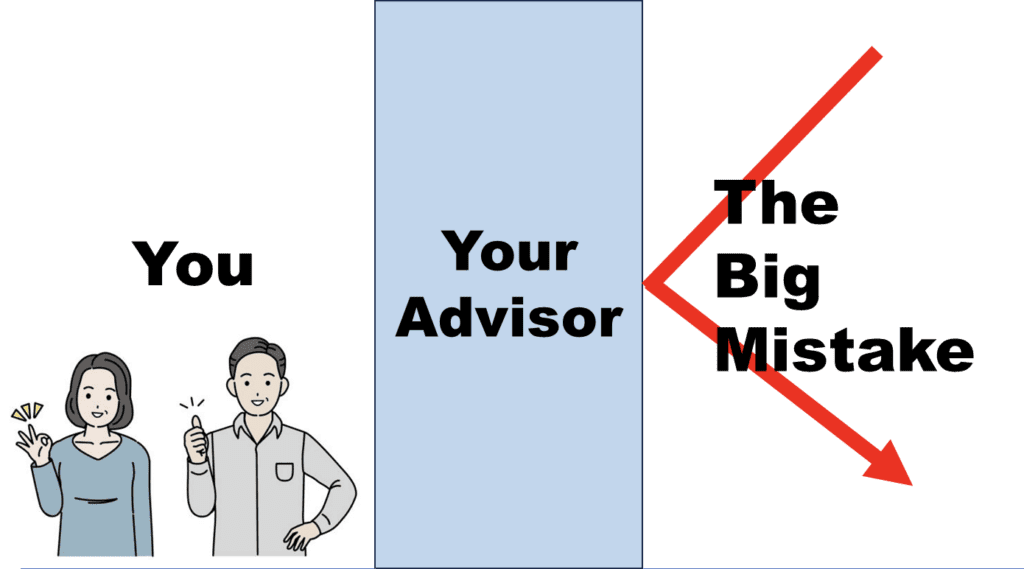

When hiring a financial advisor many people mistakenly believe that the value-add comes in the form of higher rates of return. For most people, the #1 value-add has little to do with the rate of return and everything to do with protecting you from the one big mistake. There are many situations that can cause catastrophic financial damage if not handled properly. Below are just a few examples that we have encountered:

1. Retirement Account Rollovers

While the concept of rolling over one’s employee 401k, 403b, etc. to an IRA may sound simple, it can be anything but. These retirement accounts can consist of three different “buckets” of money including pre-tax dollars, Roth dollars, and after-tax (non-Roth) dollars. Failing to have these “buckets” rolled over to the proper account types can cause catastrophic tax implications. For example, if you had a $750,000 pre-tax 401k and accidentally rolled the entire balance to a Roth IRA, you could find yourself paying tax on the entire $750,000 balance and likely end up in the highest marginal tax bracket (37%). Having a competent financial advisor handle these rollovers for you can prevent a mistake that could potentially cost you thousands in taxes.

2. Account Security

In an era of artificial intelligence, it is more difficult than ever to protect your personal information from hackers and fraudsters. While financial advisors can provide coaching on keeping information secure, inevitably some clients still become vulnerable to hacking and cyberattacks. Having a financial advisor with eyes on your accounts can help prevent fraudulent activity. When advisors are alerted to unusual activity (i.e. bank account changes, address changes, securities being sold), they have the ability to “freeze” your accounts, preventing funds from being stolen.

3. Tax-saving Strategies

The saying “you don’t know what you don’t know” could not be more applicable when it comes to tax-saving strategies. And those who are not in the know can miss out on opportunities to save big on their lifetime taxes. Two of these not-so-well-known strategies include Net Unrealized Appreciation (“NUA”) and Qualified Charitable Distributions (“QCD’s”).

Net Unrealized Appreciation “NUA” Treatment – If you work at a publicly traded company, you may own company stock within your 401k. Upon retiring, many employees do not realize that they may have the opportunity to receive preferential tax treatment on their company stock through NUA treatment. Under this treatment it is possible to avoid paying taxes on the gains in your company stock. Without being aware of this opportunity, one might make the mistake of rolling the entire 401k balance to an IRA, missing out on tax savings.

Qualified Charitable Distributions “QCD’s” – Whether it’s to your church or local animal shelter, many charitably inclined people are stroking checks to the non-profit causes that they care about. For those over the age of 70.5 there is a more tax-efficient way to give to charity that many donors are missing out on, known as qualified charitable distributions. If you are over age 70.5 you can give to charity directly from your IRA account which has several tax benefits, including the following:

- It is an “above the line deduction”, which goes on top of the “standard deduction” that most taxpayers are already using.

- It lowers the IRA account balance, lowering future required minimum distributions.

4. Inherited IRA Accounts

Upon inheriting an IRA or Roth IRA from a parent, the natural reaction for many is to cash the account out in the year of receipt or perhaps to let it sit until a need for cash arises. Unbeknownst to many, there are special rules around inherited IRA’s that can result in unnecessary taxes, penalties, or missed tax-free growth if not well thought out.

- Inherited IRA’s must be liquidated by the end of the 10th year of the IRA owner’s death.

- Hefty penalties will be assessed on individuals who fail to do so.

- IRA withdrawals are taxed as ordinary income.

- Liquidating an IRA in a single year as opposed to strategically over 10-years can result in paying otherwise avoidable taxes.

- Inherited Roth IRA’s also do not have to be liquidated for 10 years.

- By waiting until the end of the 10th year to liquidate the account, one can receive 10 years of tax-free growth.

In Summary: Protecting You from The One Big Mistake is a Key Part of what we do

The above are just a few examples of how working with a competent financial advisor could save you tens or even hundreds of thousands of dollars by protecting you from the one big mistake. How do you know if you have a sound advisor that can protect you from making that one big mistake? One indication is their credentials. If you are not working with a team who has strong industry credentials, or you are not working with an advisor at all, now may be the time to evaluate your options. At Runey & Associates Wealth Management we are proud of the high-level of confidence we provide for the families we serve through our extensive experience, education, and dedication.

Learn more about applicable credentials, our team, and our wealth of experience here.