Every four years, investors must deal with the emotional rollercoaster of a presidential election. This can be a challenging time for all. This year has been one of a kind, as our society is trying to manage a tragic pandemic and social unrest. All of this chaos does not make investing in the stock market any easier for those who may struggle with the volatility and uncertainty of how the market will react to each new headline.

Many clients have asked us the following question this year:

“How are we positioned for the election, especially since many experts are saying the market could tank if Biden wins?”

We hope to reinforce your confidence that the “long-term” strategy of investing in the stock market works! In fact, its works quite well regardless of who or which party is elected. A simple fact has reigned true over the stock market’s lifetime, and that is:

“The markets have performed well under both political parties.”

Yes, it is true! The markets have done remarkably well under both political parties. The market does not care if you do not like the president. That is a good thing! We do not want the market to care who or which party is elected. We want the market to continue to climb upwards over the long term. This trend, however, does not mean that there will not be “volatility” surrounding an election. There certainly can be, but we do not invest in the stock market for the short term. We invest for the long term.

What does this mean for you when an election comes around?

We advise our clients to remain focused on 2 primary things:

1. Have confidence that you have the right asset allocation.

Asset allocation is the most important investing decision one can make. This approach means simply determining the right balance of stocks, bonds, and cash to have in your portfolio. The great thing about having an appropriate asset allocation (based on your goals, liquidity needs, risk tolerance, proper rebalancing, etc.) is that it does not need to be changed often, if at all.

2. Stay invested.

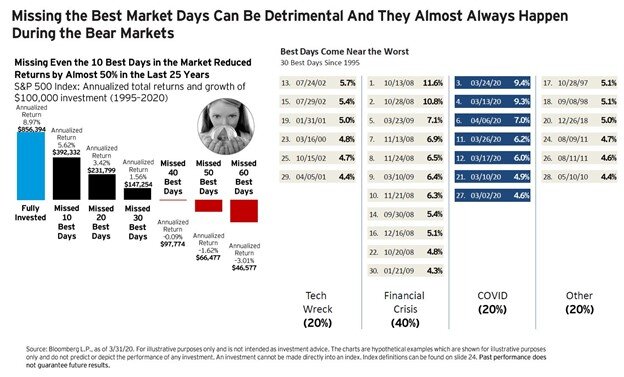

If you miss 10 of the best trading days in a year, you lose on average 5.0% rate of return for that year. The problem is that many of the best trading days happen in remarkably close proximity to the worst trading days of the year. As the graph below demonstrates, as well as this cnbc.com article, if you missed the 10 best trading days in the last 25 years, you would have forfeited nearly 50% of your returns. Also see how many of those days occur right in the middle of market depressions.

This truth reinforces the simple fact that having the right asset allocation and staying invested is the best way for investors to capture their fair share of the global market returns over the long run.

This concept is simple to understand, but it can be difficult to remember during an election year, or global crisis.