Russia’s invasion of Ukraine has triggered an emotional response for many of us, and rightfully so. It is not a surprise that this emotional response has spilled into the markets over the last few weeks. Since Russia’s invasion on February 24th, 2022 we have seen plenty of market volatility, which leaves us asking what the implications will be on the stock market going forward, and what does that mean to me as an investor. How should you handle your investments during global conflict?

Unfortunately, we do not have a crystal ball to tell us where the markets will go from here, however, during such a crisis, we look to similar events in the past to help us get an indication of what may happen in the future.

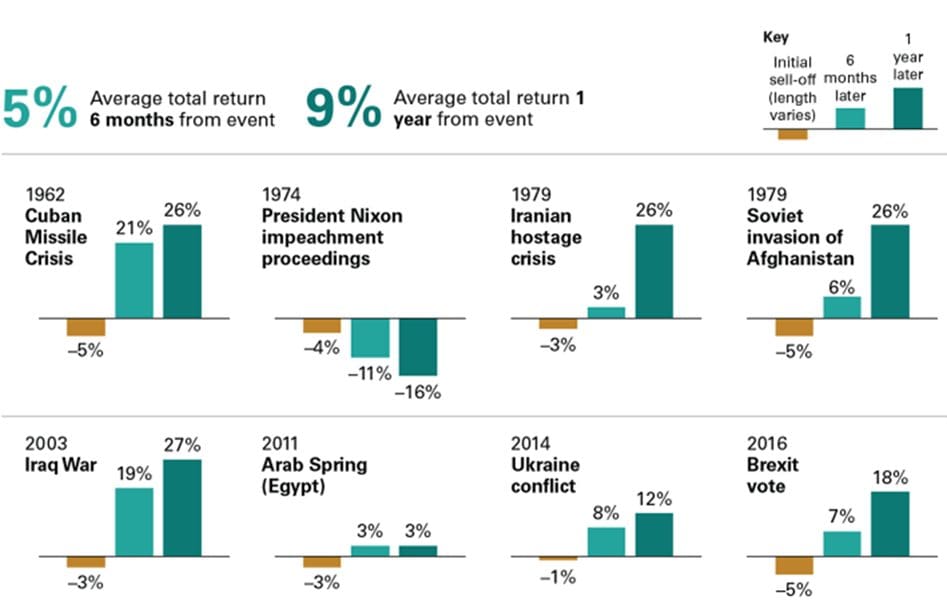

When major geopolitical events of the past are examined, we find the implications on the stock market are surprisingly in-line with typical returns. This analysis includes returns over the 6 and 12-month periods following a geopolitical event as shown in the below graphic:

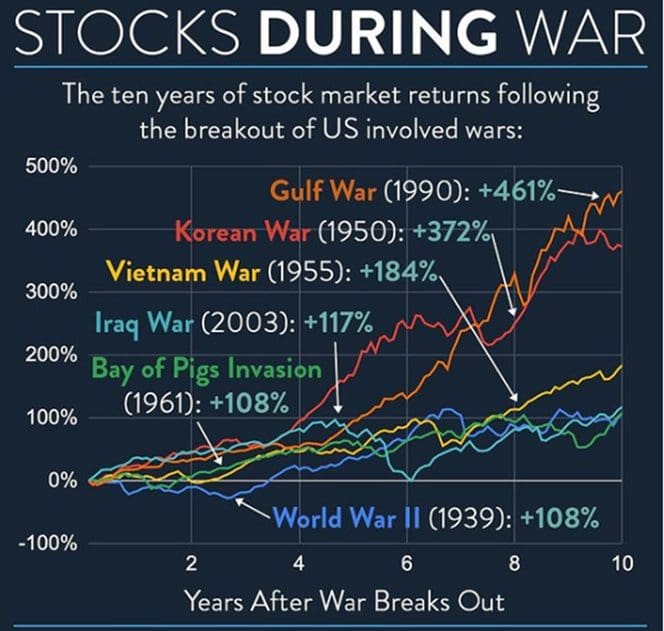

The results are similar when assessing long-term returns in the market during times of US involved wars. These statistics are evidenced in the below chart, where surprisingly, four of five of the wars shown resulted in the stock market going down at some point, only to recover to all-time highs:

While no two geopolitical events are the same, and we cannot predict what will happen with the current crisis in Ukraine, history has taught us that not making portfolio changes is likely the best course of action. The volatility related to the geopolitical events taking place will likely continue for some time, however, these events do not change our long-term perspective or investment methodology.

If you have questions or concerns about how to handle your investments during global conflict, we encourage you to reach out. We are happy to help.